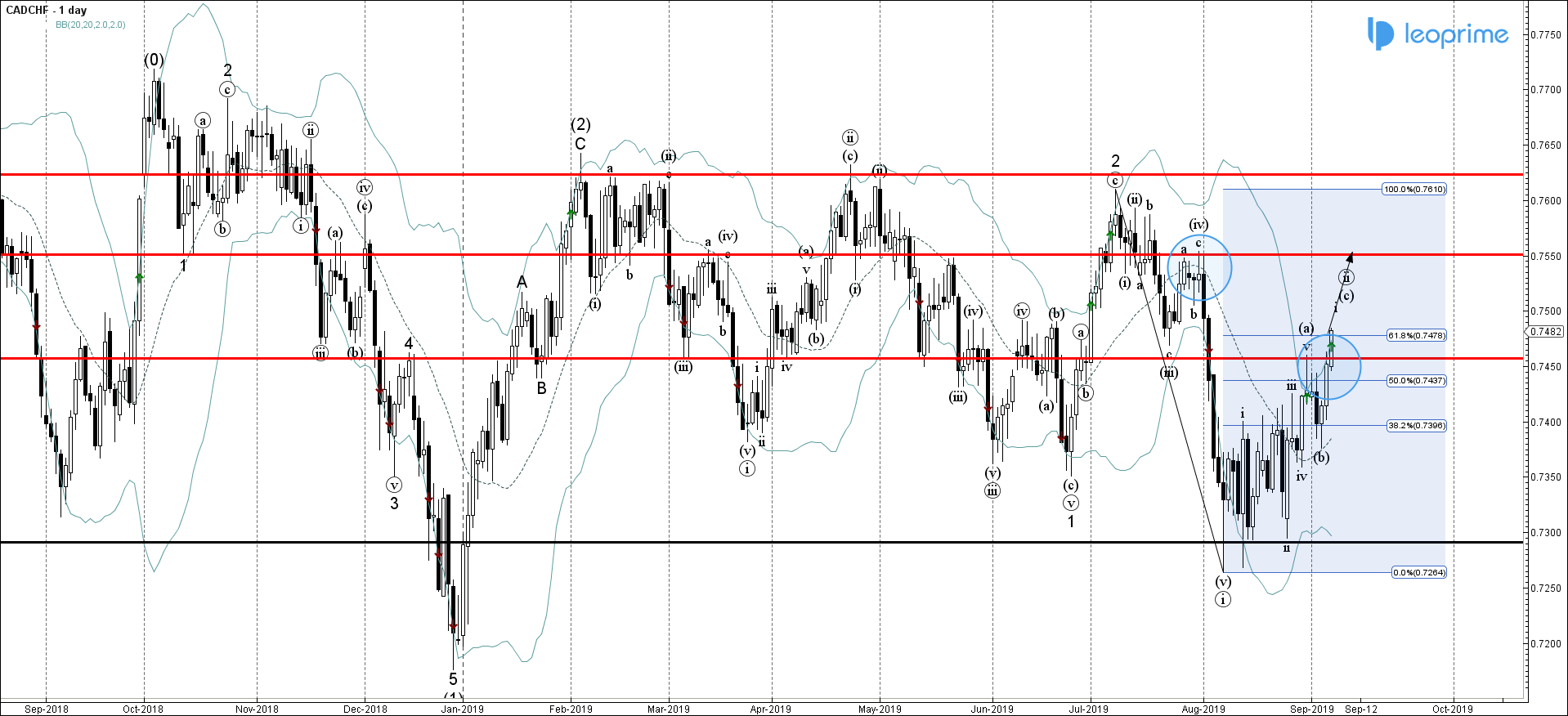

• CADCHF broke resistance level 0.7450 • Further gains likely toward 0.7550 CADCHF recently broke above the resistance area located between the resistance level 0.7450 (which stopped the previous short-term impulse wave (a) August) and the 50% Fibonacci correction of the previous sharp downward impulse (i) from the start of…

Read More- SOCIAL TRADING

- PLATFORM

- MARGIN REQUIREMENTS

- OUR BLOG'S

- ACCOUNT TYPES

- FUNDING

- TRADING INSTRUMENT

- PROMOTIONS

- PARTNERSHIP

G.S.Complex, 1st floor,

Office Number 12,

Providence,

Mahe, Seychelles.

Technical Analysis

London Breakout Strategy is a day trading strategy that seeks to take an opportunity of the Asian Trading range to the London Opening Session.

London Breakout Strategy is a day trading strategy that seeks to take an opportunity of the Asian Trading range to the London Opening Session.

London Breakout Strategy is a day trading strategy that seeks to take an opportunity of the Asian Trading range to the London Opening Session.