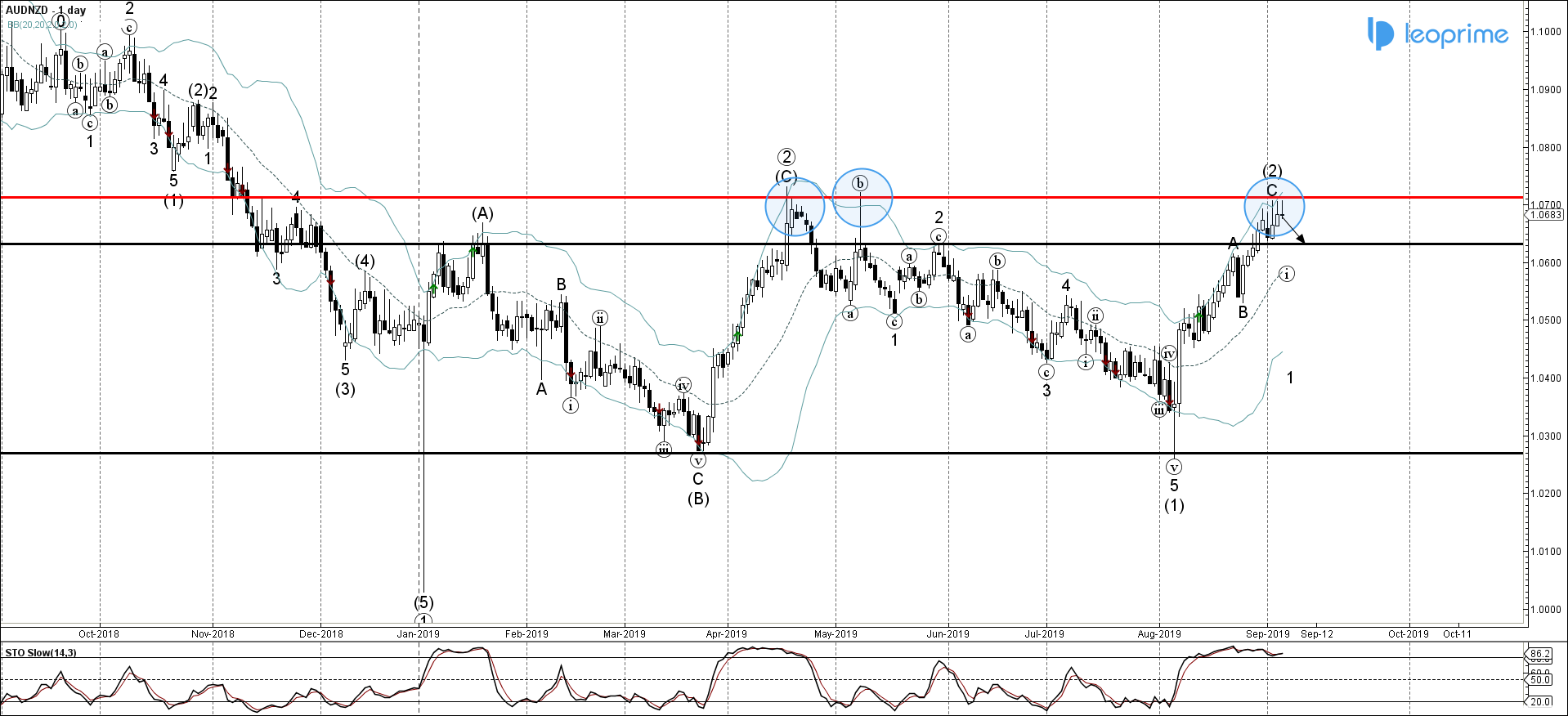

• AUDNZD reversed from long-term resistance level 1.0710

• Further losses likely toward 1.0630

AUDNZD recently reversed down from the resistance zone located between the major long-term resistance level 1.0710 (monthly high from April and May) and the upper daily Bollinger Band. The downward reversal from this

resistance zone formed the weekly Japanese candlesticks reversal pattern Shooting Star – which signalled the completion of the previous medium-term ABC correction (2) from the start of August. With the moderately bullish sentiment affecting the New Zealand Dollar and the overbought reading on the daily Stochastic indicator, AUDNZD is likely to remain under bearish pressure and retest the next support level 1.0630 (former resistance from May).