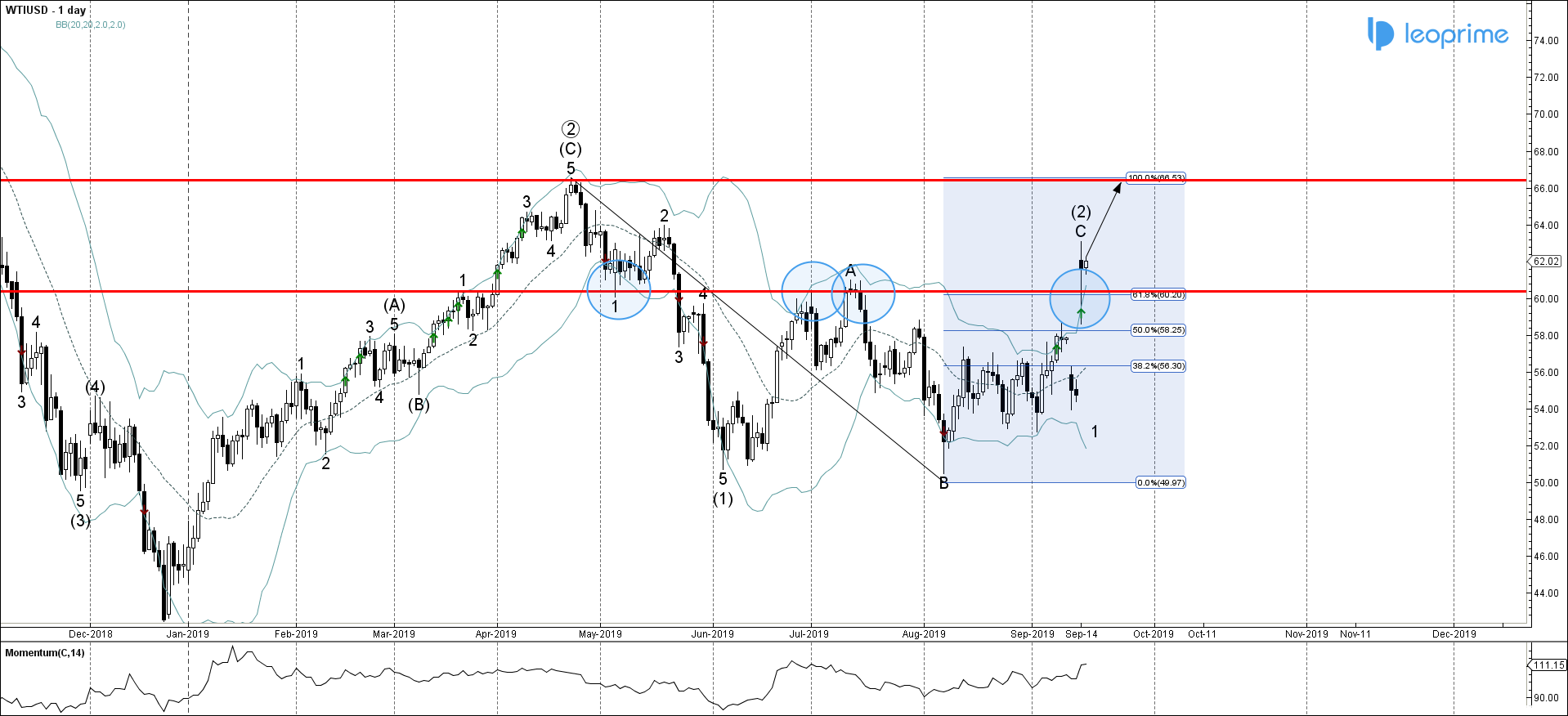

WTI previously broke through the key resistance area lying between the strong resistance level 60.40 (monthly high from June and July) and the 61.8% Fibonacci correction of the previous downward impulse from the end of April. The breakout of this resistance area continues the active impulse wave C of…

Read More- SOCIAL TRADING

- PLATFORM

- MARGIN REQUIREMENTS

- OUR BLOG'S

- ACCOUNT TYPES

- FUNDING

- TRADING INSTRUMENT

- PROMOTIONS

- PARTNERSHIP

G.S.Complex, 1st floor,

Office Number 12,

Providence,

Mahe, Seychelles.

Technical Analysis

London Breakout Strategy is a day trading strategy that seeks to take an opportunity of the Asian Trading range to the London Opening Session.

London Breakout Strategy is a day trading strategy that seeks to take an opportunity of the Asian Trading range to the London Opening Session.

London Breakout Strategy is a day trading strategy that seeks to take an opportunity of the Asian Trading range to the London Opening Session.