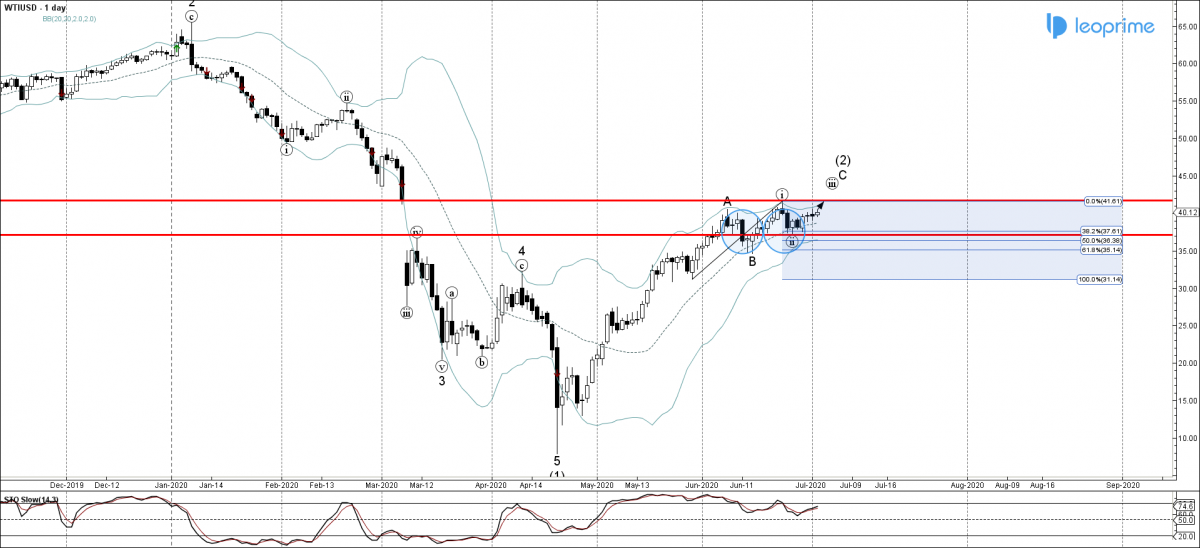

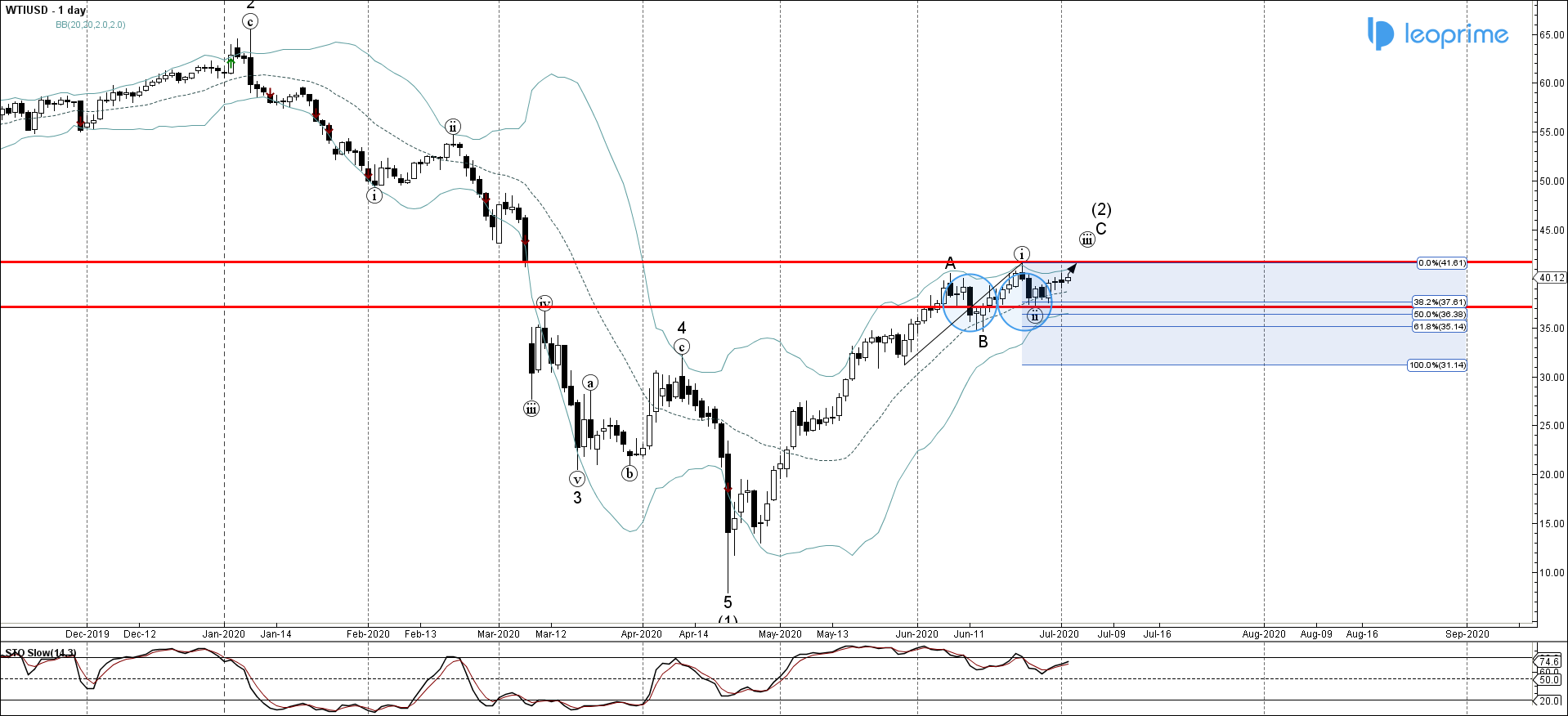

XTIUSD recently reversed up from the support level 37.00, intersecting with the 50% Fibonacci retracement of the previous upward price move from the end of May. The upward reversal from the support level 37.00 started the active short-term impulse wave (iii) – which belongs to higher-order impulse wave C from last month. Given the daily Stochastic is trading below the overbought territory – XTIUSD is likely to extend the gains in the active impulse waves C and (iii) toward the next resistance level 41.70 (top of the previous impulse wave (i) from the end of June).

XTIUSD reversed from support level 37.00; Likely to rise to 41.700