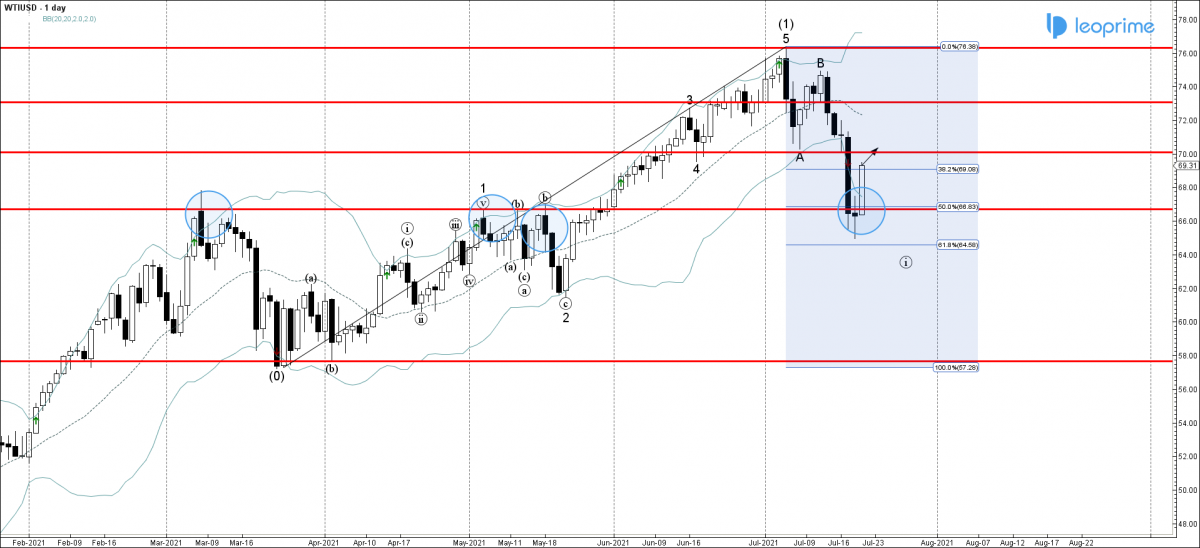

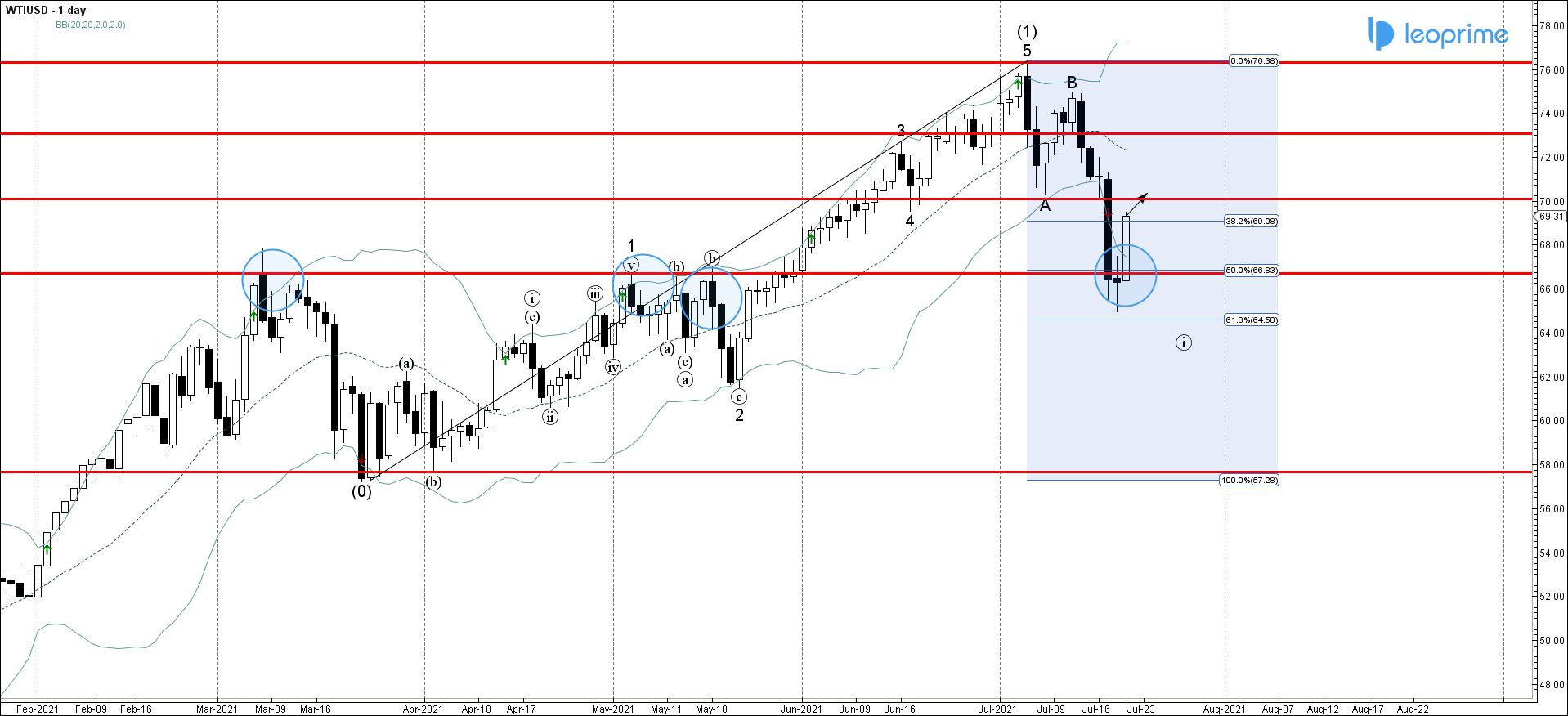

WTI crude oil recently reversed up from the support zone lying between the key support level 66.70 (former monthly high from March and April), lower daily Bollinger band and the 50% Fibonacci correction of the upward price impulse form March. The upward reversal from of this support zone created the daily reversal pattern longlegged Doji. Given the improvement demand expectations for oil demand on upbeat corporate data from USA – WTI crude oil pair can be expected to rise further toward the next round resistance level 70.00 (former support which stopped earlier wav A at the start of July).

WTI reversed from support zone; Likely to rise to resistance level 70.00