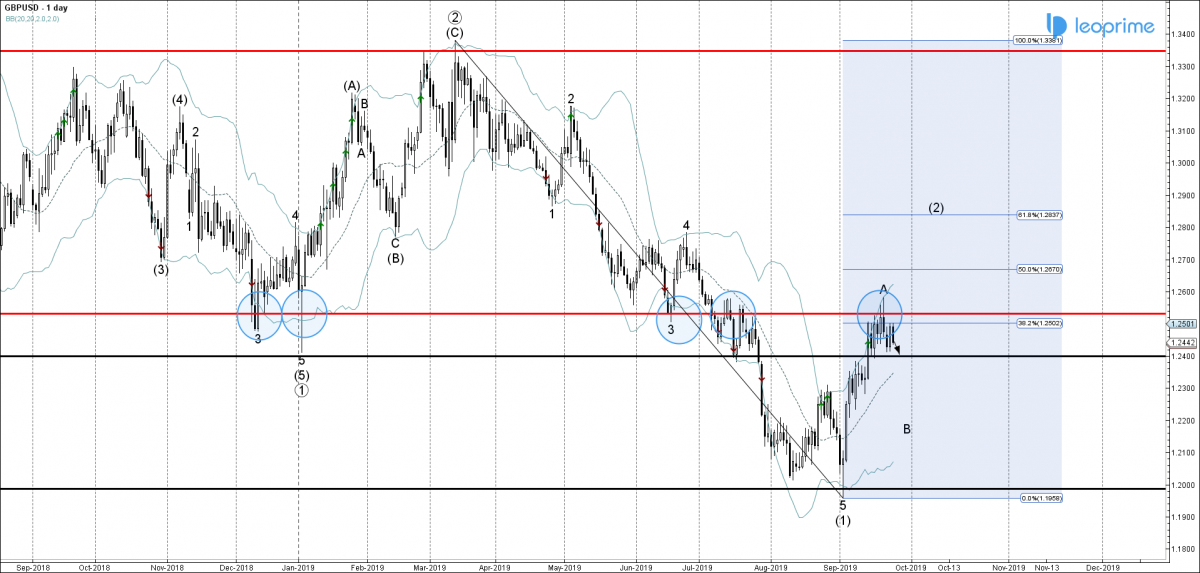

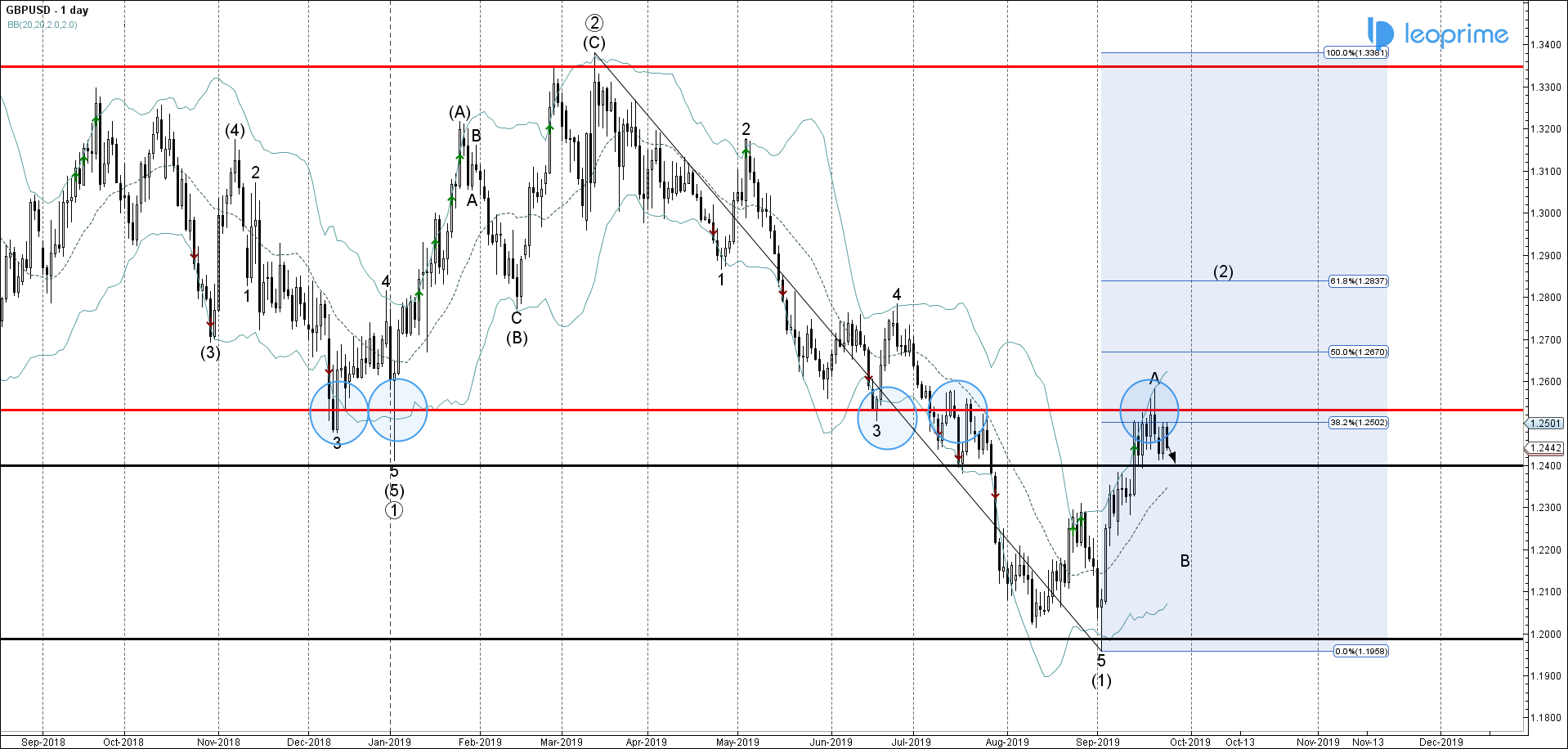

GBPUSD recently reversed down from the resistance area located between the pivotal resistance level 1.2530 (former support from June), upper daily Bollinger Band and the 38.2% Fibonacci correction of the previous downward impulse from March. The downward reversal from this resistance area started the active short-term correction B – which belongs to the ABC wave (2) from the start of September. With the moderate bearish sentiment affecting the Sterling – coupled with moderate US dollar bullishness – GBPUSD is likely to remain under bearish pressure today and continue to fall in the active short-term wave B toward the next support level 1.2400.

GBPUSD reversed from 1.2530 Resistance Area ; Further loses likely 1.24000