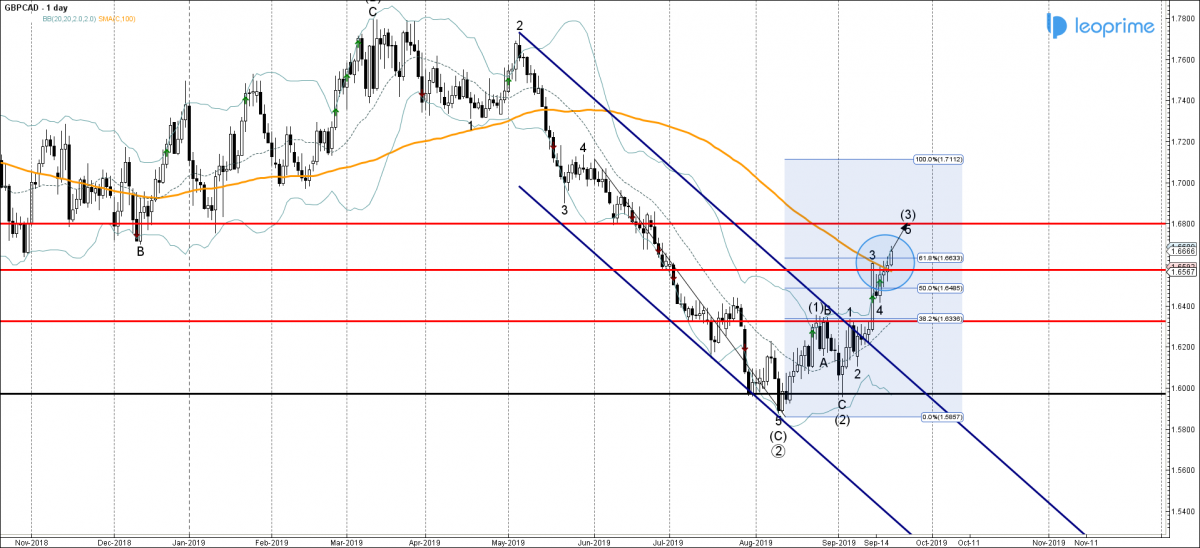

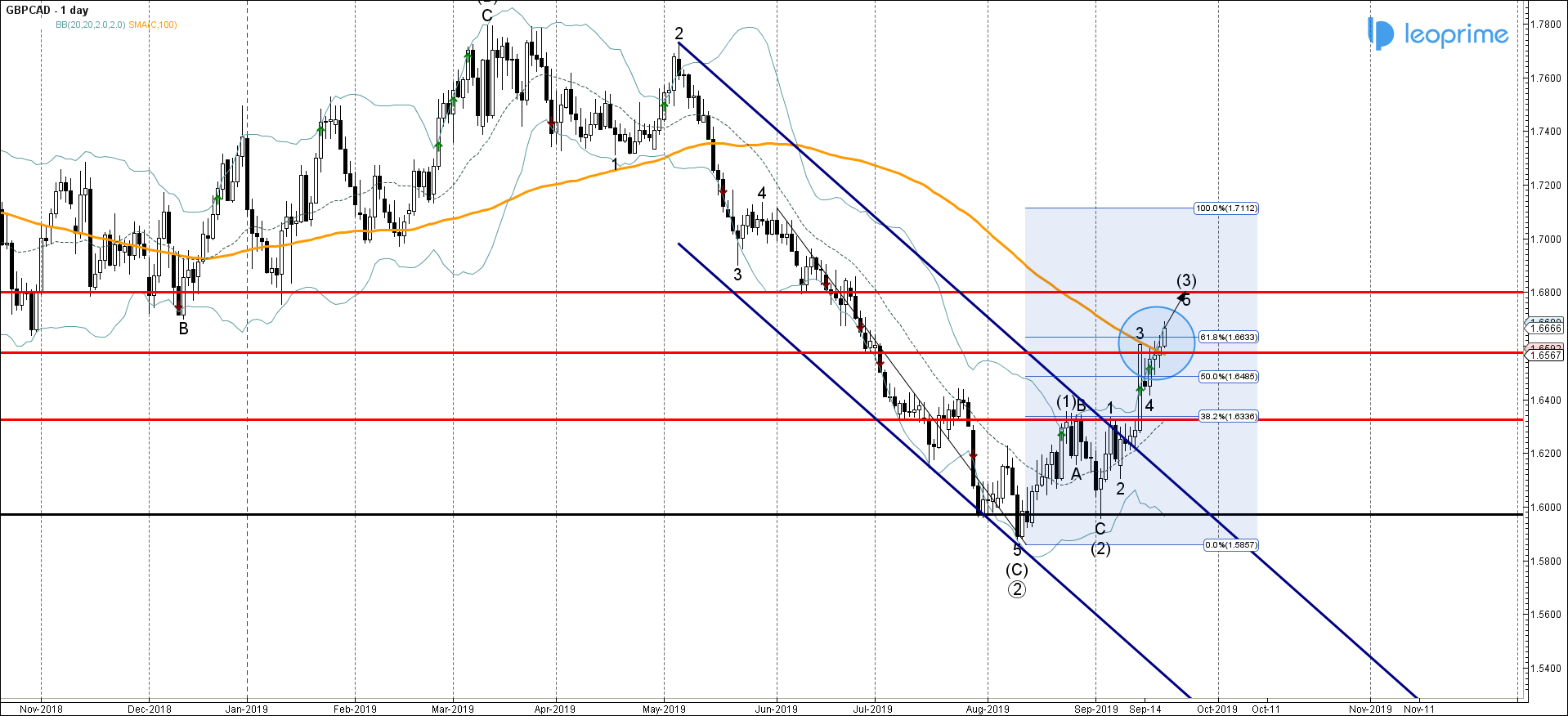

GBPCAD recently broke the resistance area lying between the key resistance level 1.6570 (which stopped the previous sharp impulse wave 3 in the middle of September), 100-day moving average and the 61.8% Fibonacci correction of the previous shard daily impulse wave 5 from May. The breakout of this resistance area accelerated the active impulse wave 3 – which belongs to the medium-term impulse wave (3) from the start of September. With the moderate bullish sentiment affecting Sterling today -GBPCAD is likely to extend the gains toward the next resistance level 1.6800 (former support from January and June and the target price for the completion of the active impulse wave 5).

GBPCAD broke the 1.6570 resistance area; Further gains likely towards 1.6800