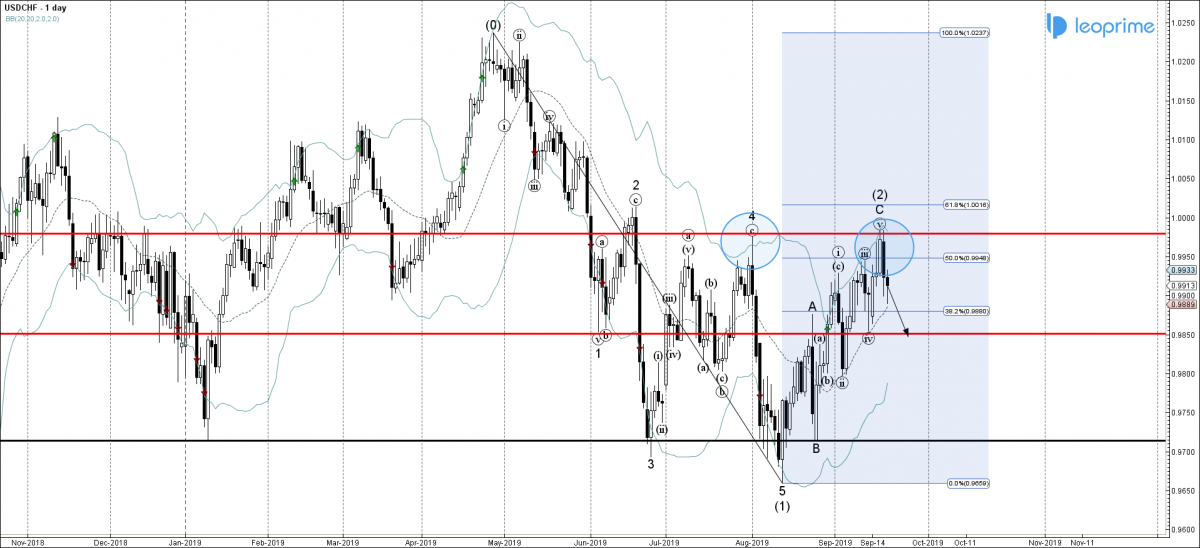

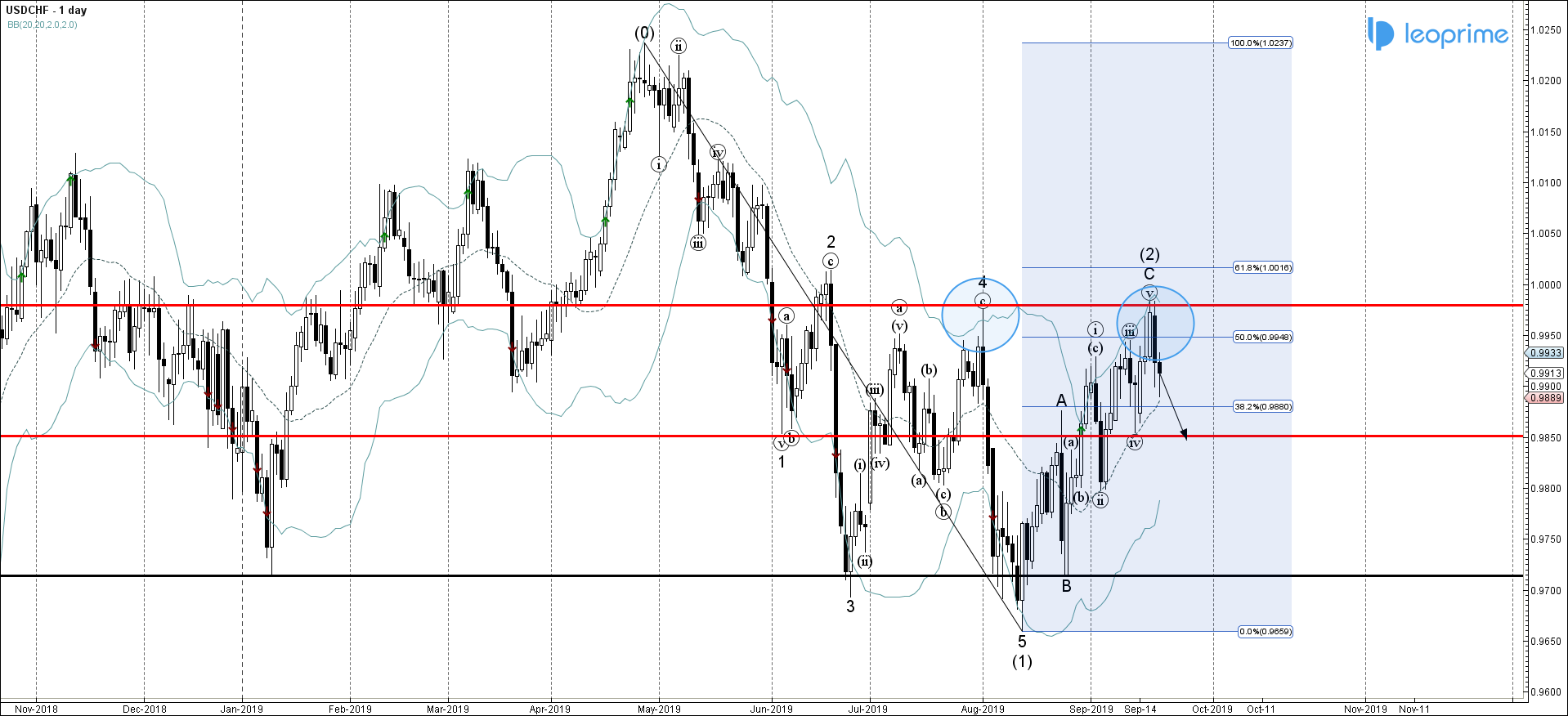

USDCHF recently reversed down from the resistance area lying between the key resistance level 0.9980 (which stopped the previous ABC correction 4 at the start of August), upper daily Bollinger Band, 61.8 Fibonacci retracement of the earlier downward impulse wave (1) from April. The downward reversal from this resistance area created the daily Japanese candlesticks reversal pattern Bearish Engulfing – which started the active impulse wave(3). With the moderate bullish sentiment affecting the Swiss Franc USDCHF is set to fall further toward the next pivotal support level 0.9850 (low of the previous short-term correction (iv)).

USDCHF reversed up from 0.9980 resistance area ; Likely to test support level 0.9850