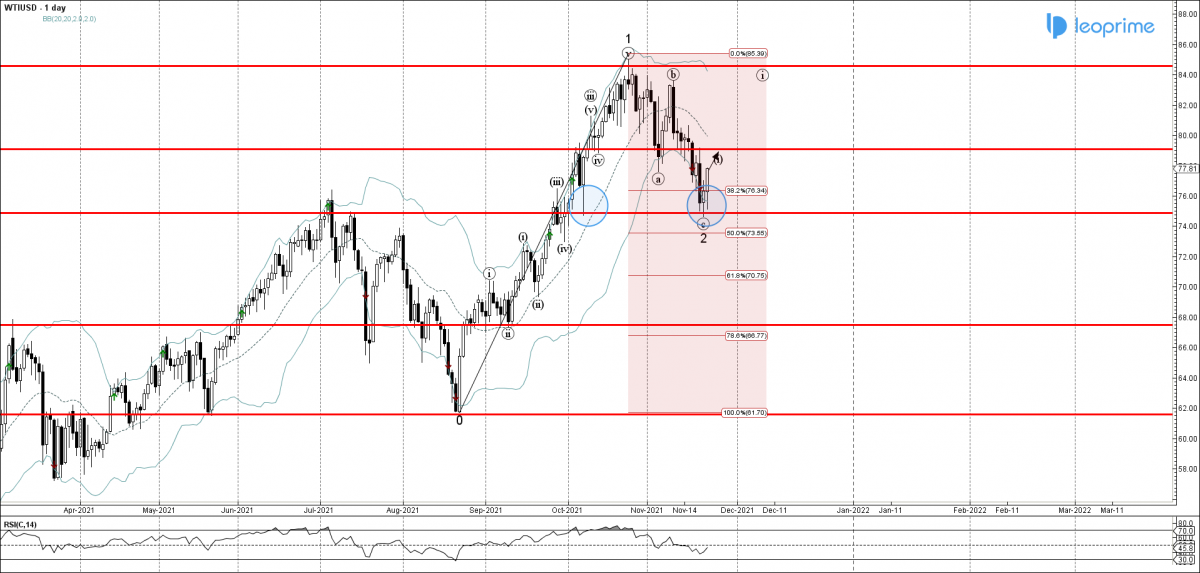

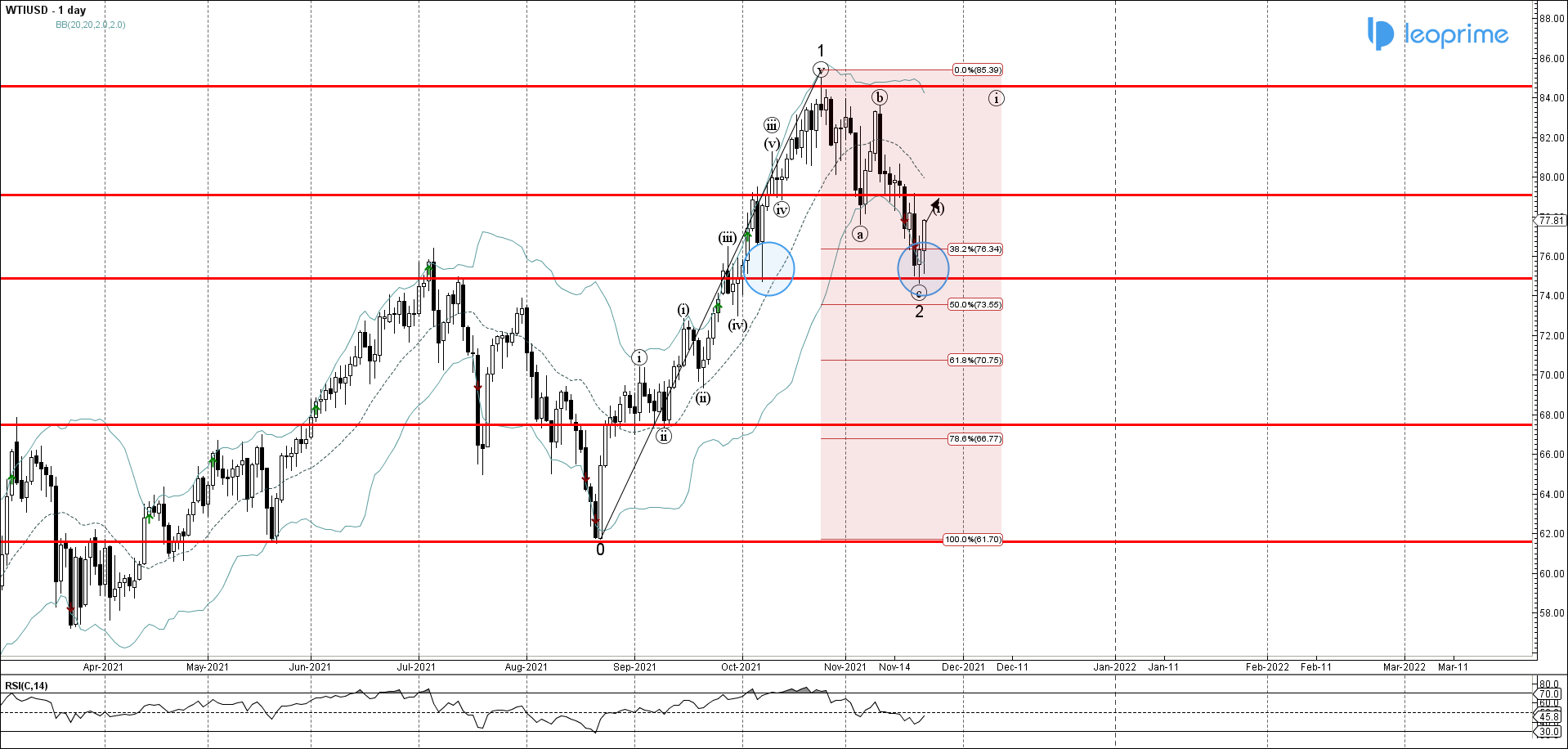

WTI crude oil continues to rise after the price reversed up from the support zone lying between the key support level 74.850 (which has been reversing the price from the start of July, as can be seen from the daily WTI chart below), lower daily Bollinger band and the 38.2% Fibonacci correction of the upward impulse 1 from August. The upward reversal from this support zone stopped the previous minor ABC correction 2 from the end of October. Given the strength of the aforementioned support zone, WTI rue oil can be expected to rise further toward the next resistance level 79.000 (target price for the completion of the active impulse wave (i)).

WTI crude oil reversed from support zone; Likely to rise to resistance level 79.000.