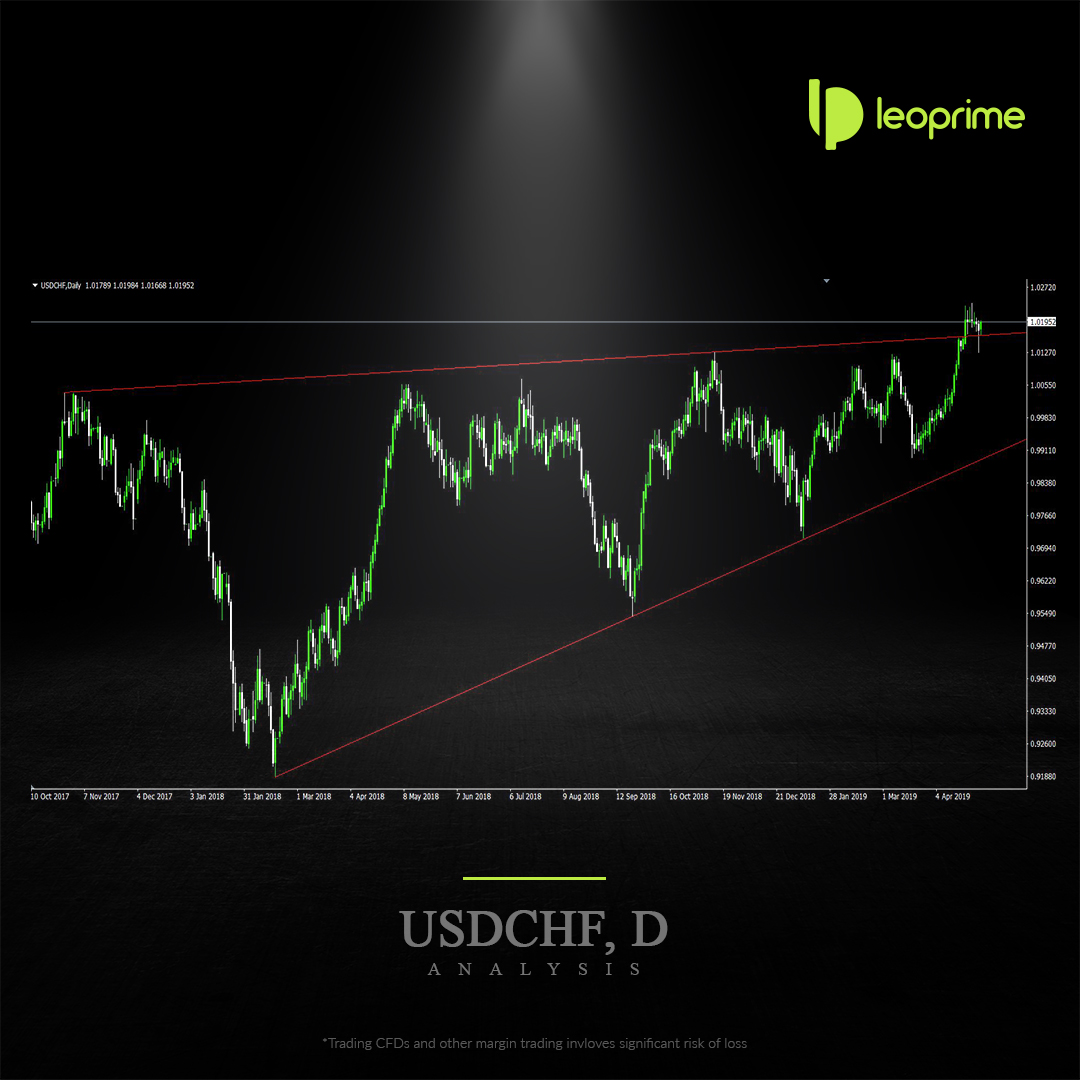

USDCHF trapped inside rising wedge pattern since OCT’2017 is finally broken upside before a couple of week and somehow tried to form a new high reaching 1.02300. As the markets was quite calm for the holidays, there was no impact in the pair to move further. Yesterday, the FOMC held on rates as expected, it was the press conference with Fed Chair Powell that sparked a strong reversal in the Dollar. The reversals posted solid technical set-ups for more follow-through strength in the Dollar in the days ahead.At 07.00 GMT, the dollar

index, which measures the greenback against a basket of six major currencies, was at 97.428, up nearly 0.5%

from before Powell’s comments. The drop caused by the FOMC broke the the wedge resistance testing 1.01500

but retested back escaping above the Wedge pattern. Currently trading at 1.01892, If the market is in favour of the bulls, with a positive economic outcome, the pair is expected to reach the January 2015 at 1.02300 forming new highs. Later this weekend we have the Jobless report, Average Earning hours Non farm payrolls and the Non-Manufacturing PMI which is highly eyed on the Market.

USDCHF TODAY:

Daily open: 1.01765

Daily Last high: 1.01982

Daily Last Low: 1.01697

Daily current growth: +0.16%