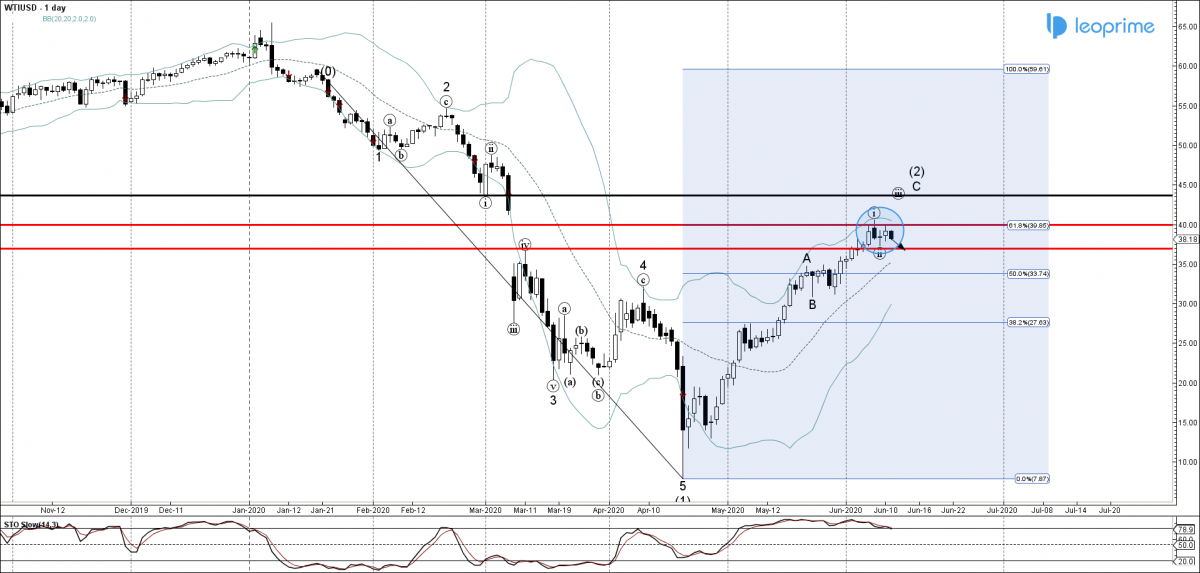

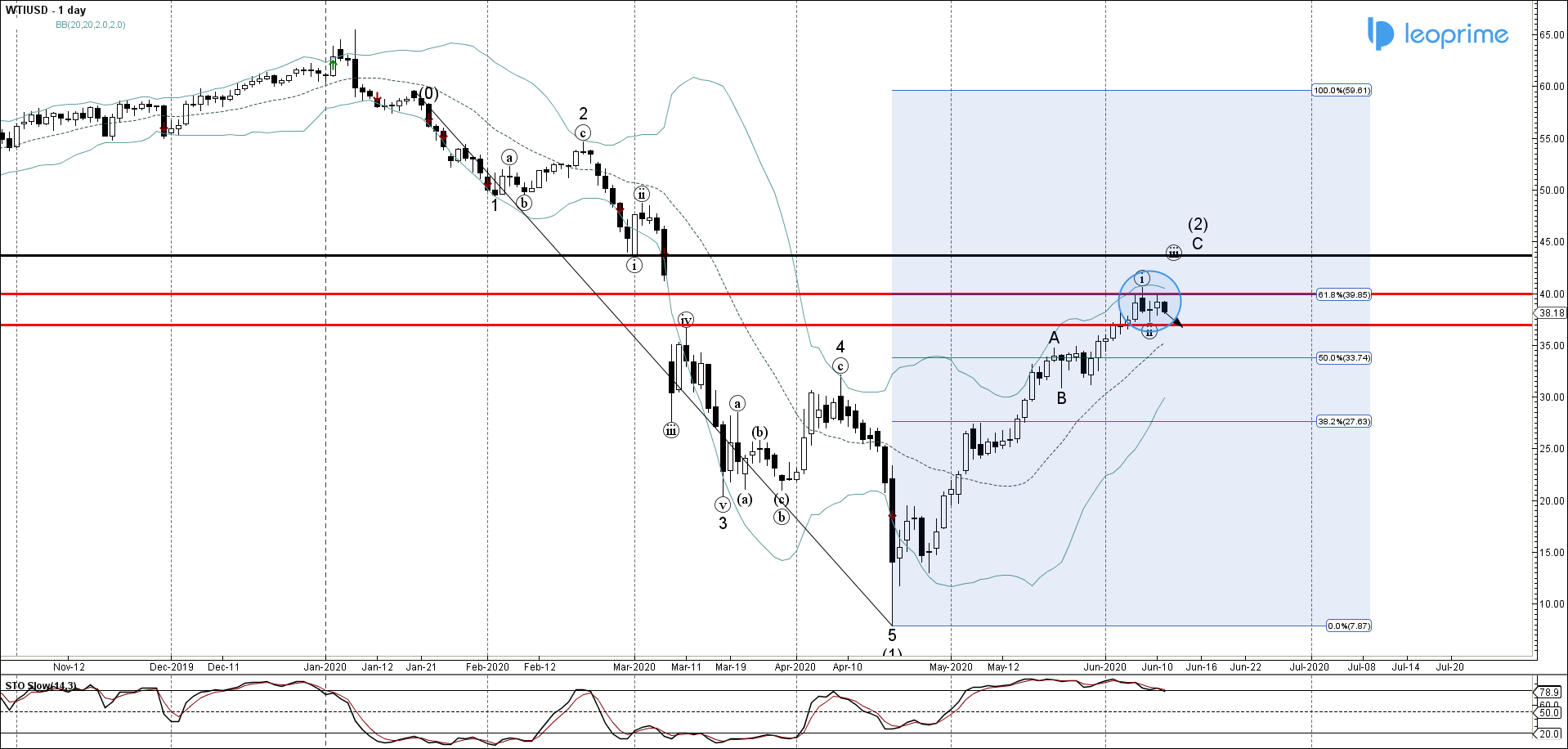

WTIUSD recently reversed down from the resistance area lying between the key round resistance level 40.00, intersecting with the upper daily Bollinger Band and the 61.8% Fibonacci correction of the previous extended

downward impulse wave from the middle of January. Given the daily Sciatic moving in the overbought territory – WTIUSD is likely to extend the losses toward the next support level 36.90 (low of the pervious short-term correction (ii) from the start of June). Strong barrier for the upward movement remains at the resistance level 40.00.

WTIUSD reversed from 40.00 resistance area; Likely to fall to 36.90