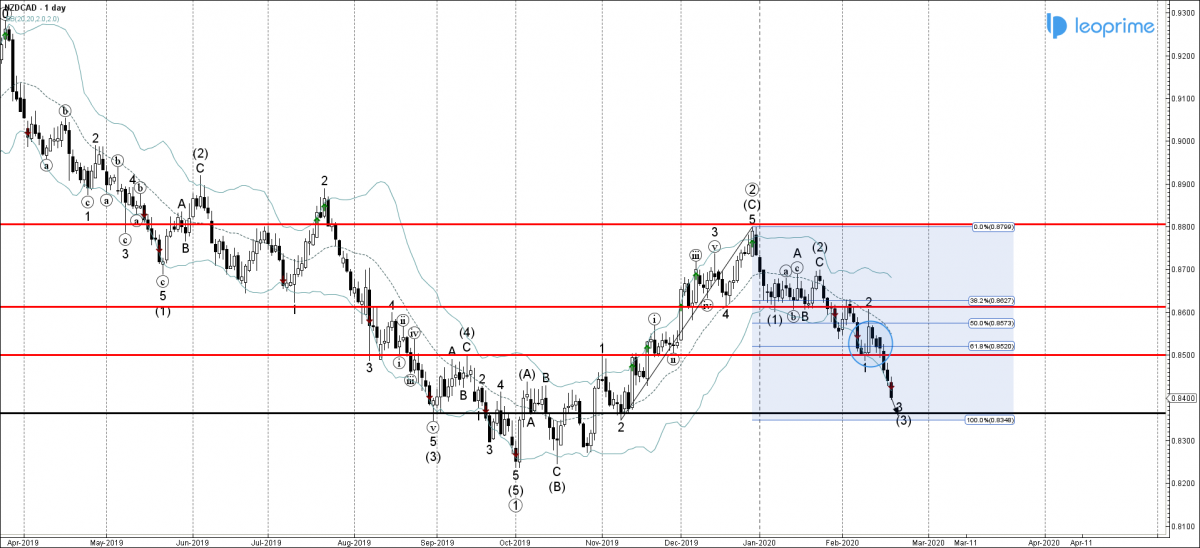

NZDCAD recently broke the support area lying between the key support level 0.85000 (which stopped the earlier impulse wave 1 in February) and the 61.8% Fibonacci correction of the previous sharp upward impulse wave from November- which accelerated the active impulse waves 3 and (3). Given the strong bearish sentiment affecting New Zealand dollar at the moment, NZDCAD is likely to extend the loses toward the next support level 0.83650 (monthly low from November and the target price for the completion of the active impulse wave 3).

NZDCAD broke 0.85000 support area; Likely to fall to 0.83650