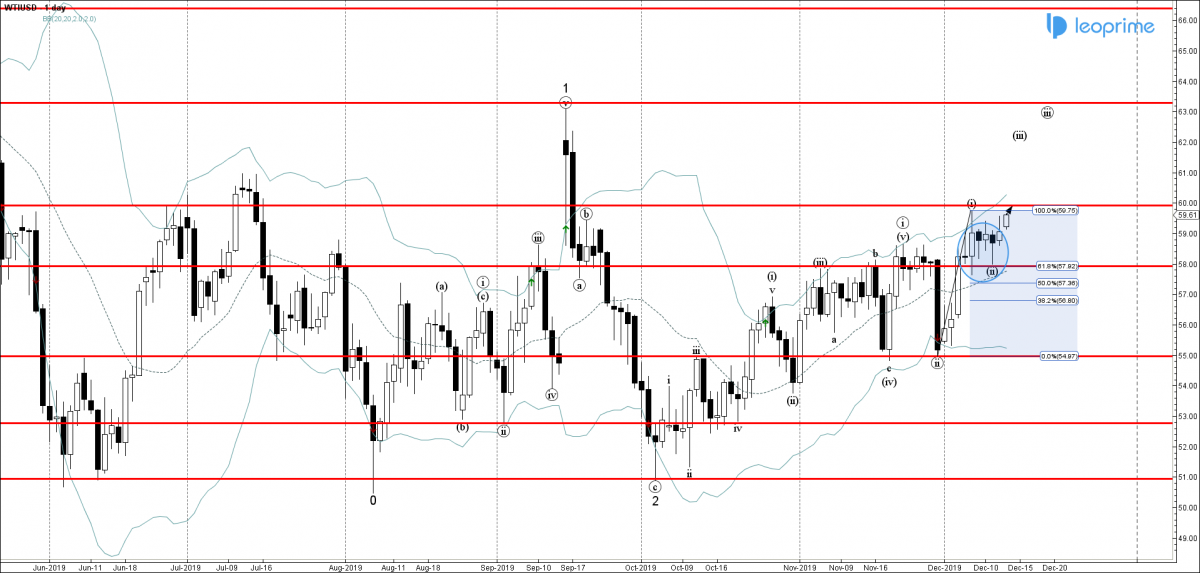

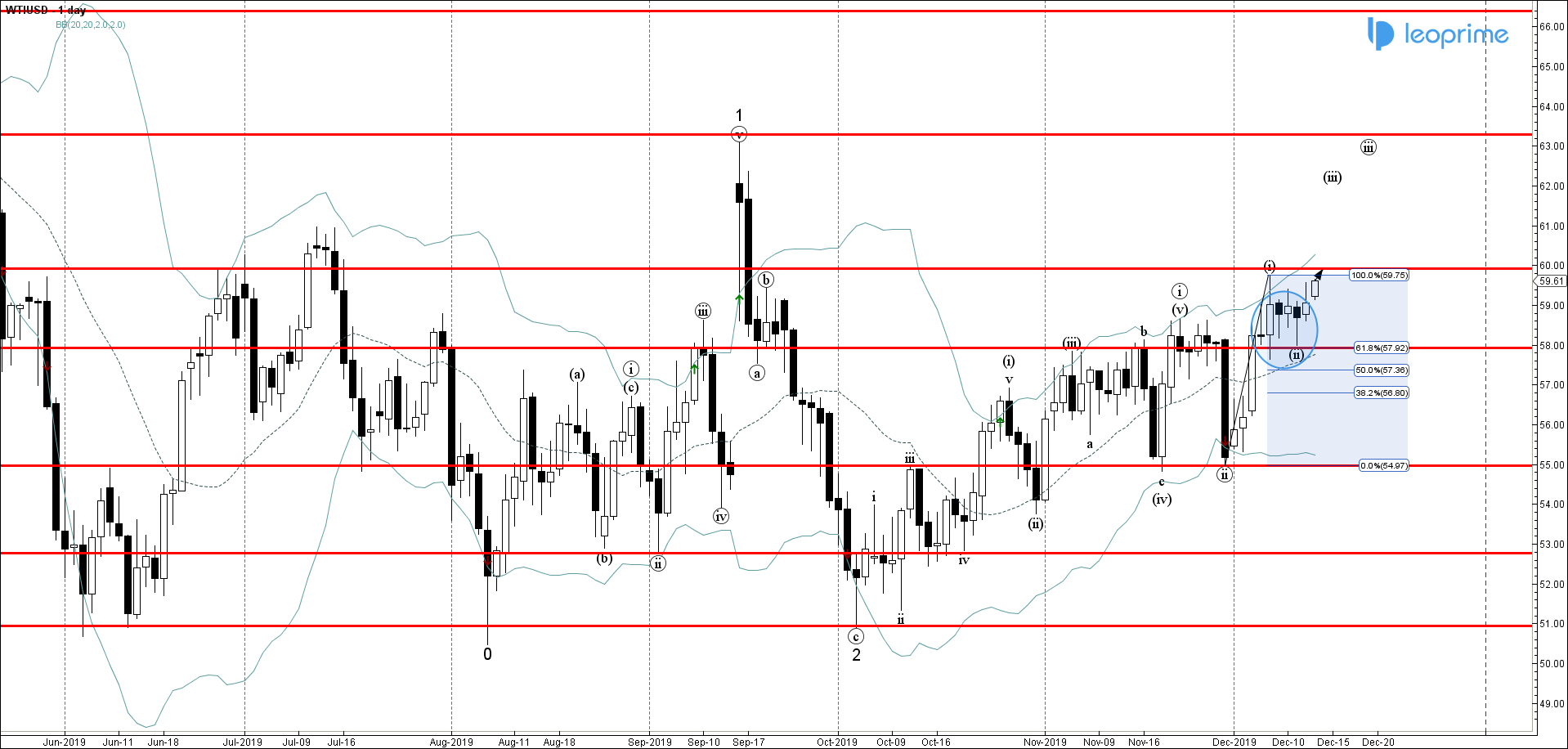

WTIUSD recently reversed up with the daily Japanese candlesticks reversal pattern Hammer from the support area lying between the support level 58.00(former resistance from November) and the 38.2% Fibonacci correction of the previous upward impulse wave (i) from last month. WTIUSD is likely to rise further in the active impulse waves (iii) and 3 toward the next resistance level 60.00(top of the impulse wave (i)from the start of December). Buy stop-loss can be placed below the aforementioned support level 58.00.

WTIUSD reversed from 58.00 support; Likely to rise to 60.00;